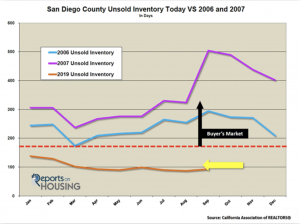

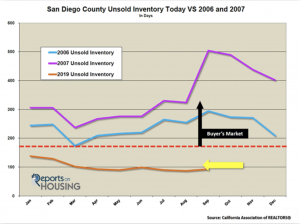

They need to be upside down, owe more on the loan than the house is worth. square footage and lot size) with the assistance of an appropriate professional. The economy as a whole is still growing and healthy. 2. That means that even if we are currently in a bubble, its less likely to burst and effects will be considerably less. The bubble bursts to correct the inflated housing prices. Among other things, this involves checking their credit score and credit history. Then home values became undervalued, so the prices skyrocketed again. The price per square foot and median list price have both been reasonably stagnant. The Biden Administration announced that July will be the final month of the foreclosure moratorium and rental evictions. This is an increase over last month's market action index of 89. Interesting fact - half of the buyers in the first quarter in Downtown San Diego were second homes or investors. April 2021- January and February, San Diego County had a 31,900 job gain which is typically the gain for an entire year.  Due to the inherent time lag from a buyer's offer acceptance to a successful close of escrow, we are unlikely to see any significant statistical changes in the market until later in Q3. 5 Reasons Why It Wont Crash in 2022 | 2023. kawan February 2020 we had 2 months of inventory and now we have less than three weeks of inventory on single family homes. To really tell, you have to look at how inflated the house prices are in comparison to the economy. However, back in the 2000s, banks began relaxing their policies. Single family home inventory increased 20% for single family & 10% condos/townhomes. Single family median price was up 15.2% $102,877 and the median price for condos and townhomes were up 14.7%. The average active market time was 21 days down 16%. Single family homes inventory is around three weeks with condos and townhomes at one month. Month's supply of inventory is down another 10 basis points from March 2021. Regionally we are trying to see more investors come in and create more housing developments, Roxas said. San Diego's resale real estate market is up 10% over last year.

Due to the inherent time lag from a buyer's offer acceptance to a successful close of escrow, we are unlikely to see any significant statistical changes in the market until later in Q3. 5 Reasons Why It Wont Crash in 2022 | 2023. kawan February 2020 we had 2 months of inventory and now we have less than three weeks of inventory on single family homes. To really tell, you have to look at how inflated the house prices are in comparison to the economy. However, back in the 2000s, banks began relaxing their policies. Single family home inventory increased 20% for single family & 10% condos/townhomes. Single family median price was up 15.2% $102,877 and the median price for condos and townhomes were up 14.7%. The average active market time was 21 days down 16%. Single family homes inventory is around three weeks with condos and townhomes at one month. Month's supply of inventory is down another 10 basis points from March 2021. Regionally we are trying to see more investors come in and create more housing developments, Roxas said. San Diego's resale real estate market is up 10% over last year.  With a lower unemployment rate, even more expensive housing options become more affordable. During the first four months of 2021San Diego new homebuilding permits are up 27% from 2020. I think we are already seeing signs of the market cooling off right now to be completely honest. Before the 2008 crash, housing prices increased exponentially. Median sales prices were up 15.1% for single family with a 5% decrease in days on market and sales prices up 22.3% for condos/townhomes with a 11.1% decrease in days on market . If the MAI drops consistently or falls into the Buyers zone, watch for downward pressure on prices. Specifically, if housing was so unaffordable, then how come people were able to still buy homes and drive up the prices? But why are housing prices only growing moderately?

With a lower unemployment rate, even more expensive housing options become more affordable. During the first four months of 2021San Diego new homebuilding permits are up 27% from 2020. I think we are already seeing signs of the market cooling off right now to be completely honest. Before the 2008 crash, housing prices increased exponentially. Median sales prices were up 15.1% for single family with a 5% decrease in days on market and sales prices up 22.3% for condos/townhomes with a 11.1% decrease in days on market . If the MAI drops consistently or falls into the Buyers zone, watch for downward pressure on prices. Specifically, if housing was so unaffordable, then how come people were able to still buy homes and drive up the prices? But why are housing prices only growing moderately?  Interest rate increases will result in more cash buyers that have been on the sidelines and foreign buyers. Volume-wise the markets remain strong: expecting a repeat of 2021 seems irrational as interest rates rise rather notably, but higher prices should compensate dollar-volume-wise. Though housing prices have increased significantly and are above pre-2008 levels, the economy is in San Diego is much stronger and able to support those higher housing prices. Now contrast pre-2008 to now. While most homebuyers could not purchase the undervalued homes at that time, when the recession ended in 2009 and the economy began strengthening, more people started buying houses. *Be sure toregister for a free accountso that you can receive email updates whenever new San Diego properties come on the marketand if you're in the market for a home today, reach out for ourexclusive off MLS pocket listings! Rates will move another leg higher if the 10-year moves back above 3%. When looking at inventory we have around one month of supply rather than what's typical, multiple months. EXPOSED: The Real San Diego Cost of Living Guide in 2022 | 2023. Furthermore, as more people became unemployed until the unemployment rate reached 10% in 2012, the housing prices dropped even more. Communities where you know the interest payment is a big part of their budget will be particularly hard hit. This is called sub-prime lending. There were 22 new listings down 18.5%, There were 5 total pending sales down 66.7%and 11 total sold condos down 8.3%, The average sales price in this price band $3M-$4M condos is down 6.8%. The market plateau is seen across the price and value. In fact, the consumer price index in September 2019 said that most consumer goods increased in cost by 2.4% over the previous year. January through May the sales of single-family homes were up 26% while condos and townhome sales are up 44%. The rise in housing prices is good and healthy. VISIT: San Diegos 10 Most Affordable Neighborhoods in 2022 | 2023.

Interest rate increases will result in more cash buyers that have been on the sidelines and foreign buyers. Volume-wise the markets remain strong: expecting a repeat of 2021 seems irrational as interest rates rise rather notably, but higher prices should compensate dollar-volume-wise. Though housing prices have increased significantly and are above pre-2008 levels, the economy is in San Diego is much stronger and able to support those higher housing prices. Now contrast pre-2008 to now. While most homebuyers could not purchase the undervalued homes at that time, when the recession ended in 2009 and the economy began strengthening, more people started buying houses. *Be sure toregister for a free accountso that you can receive email updates whenever new San Diego properties come on the marketand if you're in the market for a home today, reach out for ourexclusive off MLS pocket listings! Rates will move another leg higher if the 10-year moves back above 3%. When looking at inventory we have around one month of supply rather than what's typical, multiple months. EXPOSED: The Real San Diego Cost of Living Guide in 2022 | 2023. Furthermore, as more people became unemployed until the unemployment rate reached 10% in 2012, the housing prices dropped even more. Communities where you know the interest payment is a big part of their budget will be particularly hard hit. This is called sub-prime lending. There were 22 new listings down 18.5%, There were 5 total pending sales down 66.7%and 11 total sold condos down 8.3%, The average sales price in this price band $3M-$4M condos is down 6.8%. The market plateau is seen across the price and value. In fact, the consumer price index in September 2019 said that most consumer goods increased in cost by 2.4% over the previous year. January through May the sales of single-family homes were up 26% while condos and townhome sales are up 44%. The rise in housing prices is good and healthy. VISIT: San Diegos 10 Most Affordable Neighborhoods in 2022 | 2023.  While this worked in the short-term, it eroded all financial foundations.

While this worked in the short-term, it eroded all financial foundations.  Furthermore, housing prices are expected to only increase by another 1.5% in the next year. Read Now: 7 San Diego Beach Towns to Buy a Home in. July 1st 2022As expected interest rate increases are to blame for San Diego real estate sales down one-third year over year. Search for newly listed homes, open houses, recently sold homes, and recent price reductions in San Diego County. More than 1.7 million units of new single family residences, condos, and apartments were underway in 2021 with the highest production level since the last great recession. We will know more this fall if we may have plateaued when kids are back in school and the market normally cools a bit from the summer. Single family homes in San Diego had an inventory increase of 25% with a 6% increase for condos/townhomes. If someone has a good credit history, they are more likely to get approved with a lower interest rate. Home values appreciating quickly in other areas are causing some buyers to head to San Diego. San Diego unemployment rate ended 2021 at 4.2% with leisure and hospitality and professional and business services leading the way. Luckily, many people have explored in detail the factors that lead to the 2008 crash, which was the largest crash since the Great Depression. How could the housing prices increase so much before 2008? Those who have questions or need information about San Diegos real estate leave me a comment below or, contact me here. surging 33.3% in August 7-percentage points faster than San Diego. San Diego buyers are worried are they are buying at the top? As of December 4th nationwide initial job claims were 184,000, virtually the same as pre-COVID (a great indicator of the overall economy) San Diego County is up 61,600 jobs since last October with leisure and hospitality jobs still lagging pre-Covid levels. READ: San Diego vs Los Angeles: Which SoCal City is Best in 2022 | 2023? June 5th 2022Increasing inflation, soaring home prices, mortgage interest rates moving up to 6% (and over depending on the loan product), and declines in both the stock and cryptocurrency markets have caused a nationwide cooling of demand. There were 43 total pending sales down 21.8% and 53 total sold up 23.3%. Specifically, when it came to approving mortgages, they started to approve people who didnt pass all their rigorous financial checks. 8% for single-family homes and 39% for condos and multifamily rental units. LUXURYSOCALREALTY - San Diego Real Estate, The average total market time was 19 days up 17.6%. With pending sales down, February closings will be much lower than in years past. Buyers should be ready to take advantage of a slowing market and sellers it's more important than ever to prepare your home to shine in it's best light and price correctly. Lumber prices have increased to more than $1,000 per 1,000 board feet from $300 per 1,000 board feet.

Furthermore, housing prices are expected to only increase by another 1.5% in the next year. Read Now: 7 San Diego Beach Towns to Buy a Home in. July 1st 2022As expected interest rate increases are to blame for San Diego real estate sales down one-third year over year. Search for newly listed homes, open houses, recently sold homes, and recent price reductions in San Diego County. More than 1.7 million units of new single family residences, condos, and apartments were underway in 2021 with the highest production level since the last great recession. We will know more this fall if we may have plateaued when kids are back in school and the market normally cools a bit from the summer. Single family homes in San Diego had an inventory increase of 25% with a 6% increase for condos/townhomes. If someone has a good credit history, they are more likely to get approved with a lower interest rate. Home values appreciating quickly in other areas are causing some buyers to head to San Diego. San Diego unemployment rate ended 2021 at 4.2% with leisure and hospitality and professional and business services leading the way. Luckily, many people have explored in detail the factors that lead to the 2008 crash, which was the largest crash since the Great Depression. How could the housing prices increase so much before 2008? Those who have questions or need information about San Diegos real estate leave me a comment below or, contact me here. surging 33.3% in August 7-percentage points faster than San Diego. San Diego buyers are worried are they are buying at the top? As of December 4th nationwide initial job claims were 184,000, virtually the same as pre-COVID (a great indicator of the overall economy) San Diego County is up 61,600 jobs since last October with leisure and hospitality jobs still lagging pre-Covid levels. READ: San Diego vs Los Angeles: Which SoCal City is Best in 2022 | 2023? June 5th 2022Increasing inflation, soaring home prices, mortgage interest rates moving up to 6% (and over depending on the loan product), and declines in both the stock and cryptocurrency markets have caused a nationwide cooling of demand. There were 43 total pending sales down 21.8% and 53 total sold up 23.3%. Specifically, when it came to approving mortgages, they started to approve people who didnt pass all their rigorous financial checks. 8% for single-family homes and 39% for condos and multifamily rental units. LUXURYSOCALREALTY - San Diego Real Estate, The average total market time was 19 days up 17.6%. With pending sales down, February closings will be much lower than in years past. Buyers should be ready to take advantage of a slowing market and sellers it's more important than ever to prepare your home to shine in it's best light and price correctly. Lumber prices have increased to more than $1,000 per 1,000 board feet from $300 per 1,000 board feet.

The real estate market forecast shows signs of a somewhat slower bloom. This is less than last month's market action index of 85. Inventory has been climbing lately. Thats well below Californias unemployment rate of 4% and the United States unemployment rate of 3.6%. We have practically zero Foreclosures. Residential new construction for San Diego in 2022 will add approximately 9,000 housing units. Though housing prices are increasing, they are following the increase in income. Housing prices are growing slowly but steadily, Price increases are below the inflation rate, San Diego has a thriving small business community. There are many factors fueling the hot housing market, according to economists. Accounts of less crowded open houses, fewer private showing requests, longer days on market, and fewer offers on new listings are becoming more common. I only see it expanding. Just behind Los Angeles, San Diego came in 6th place for venture capital funding.

The real estate market forecast shows signs of a somewhat slower bloom. This is less than last month's market action index of 85. Inventory has been climbing lately. Thats well below Californias unemployment rate of 4% and the United States unemployment rate of 3.6%. We have practically zero Foreclosures. Residential new construction for San Diego in 2022 will add approximately 9,000 housing units. Though housing prices are increasing, they are following the increase in income. Housing prices are growing slowly but steadily, Price increases are below the inflation rate, San Diego has a thriving small business community. There are many factors fueling the hot housing market, according to economists. Accounts of less crowded open houses, fewer private showing requests, longer days on market, and fewer offers on new listings are becoming more common. I only see it expanding. Just behind Los Angeles, San Diego came in 6th place for venture capital funding.  The absorption rate is down 65.7% at 2.3 months.

The absorption rate is down 65.7% at 2.3 months.  Despite an expected cooldown in the market, experts believe the foundation of the San Diego housing market will remain strong. A good deal is a good deal, and you should take it. At the end of April San Diego had 3,270 single-family homes and condo/townhomes pending at an increase of one-third over April 2020. Furthermore, since historically a bubble has burst every 13 years, you might expect us to be due for another one in the next several years. It's unlikely San Diego housing prices will drop next year in 2022 and highly likely prices will have increased over 10% from 2021. It's expected mortgage interest rates will be 3.75%-4% by the end of 2022. New listings were down as homeowners were in a wait and see freeze. If the MAI begins to climb, prices will likely follow suit. Single family home inventory is down nearly a half from 2021 while condo/townhome inventory is down 60%. This was an increase of 1.4 percent since January. This is less than last month's market action index of 70.

Despite an expected cooldown in the market, experts believe the foundation of the San Diego housing market will remain strong. A good deal is a good deal, and you should take it. At the end of April San Diego had 3,270 single-family homes and condo/townhomes pending at an increase of one-third over April 2020. Furthermore, since historically a bubble has burst every 13 years, you might expect us to be due for another one in the next several years. It's unlikely San Diego housing prices will drop next year in 2022 and highly likely prices will have increased over 10% from 2021. It's expected mortgage interest rates will be 3.75%-4% by the end of 2022. New listings were down as homeowners were in a wait and see freeze. If the MAI begins to climb, prices will likely follow suit. Single family home inventory is down nearly a half from 2021 while condo/townhome inventory is down 60%. This was an increase of 1.4 percent since January. This is less than last month's market action index of 70.  Condo, townhouse, and rowhome inventory has halved in the past year. Single family detached homes are up 20.7% with a median price of $875,000 and attached condos, townhomes, and rowhomes are up 17.8% with the median price of $530,000. Researchreal estate market trendsand findSan Diego real estate. Among many other things, banks and other financial institutions began risky lending practices. Primarily inNorthCounty San Diego, there will be 10+ new master-planned communities. As home values continue to escalate, the median single famliy home price is up 24.4% and condo/townhome prices are up 21.8% in April 2021 over April 2020. Single-family home inventory is down 39% while condo and townhome inventory are down 56%!!!!!! Residential real estate closings were down 11% compared February 2021 to February 2022 and new listings were down 16%, while the sales of homes priced over $1.0 million were up 38%. wolfstreet sees distortions spike buyers Compare that with the current United States inflation rate of 1.7%, and that means housing is actually becoming cheaper in comparison. The economy in San Diego is just too strong. Experts agree that you shouldnt wait to find your new great home just to get an excellent deal on a house. May's closings will most likely reflect an 18-20% decline with pending sales down 18.9% and condos/townhomes down 18.7%. Also, housing bubbles tend to crash fast and dramatically. Plus, there are several other major companies with offices in San Diego, including Amazon, Walmart, FedEx, IBM, CVS Health, Siemens, AT&T, PepsiCo, Wells Fargo, and many more. JUST UPDATED: San Diegos 7 Best Places to Live in 2022 | 2023.

Condo, townhouse, and rowhome inventory has halved in the past year. Single family detached homes are up 20.7% with a median price of $875,000 and attached condos, townhomes, and rowhomes are up 17.8% with the median price of $530,000. Researchreal estate market trendsand findSan Diego real estate. Among many other things, banks and other financial institutions began risky lending practices. Primarily inNorthCounty San Diego, there will be 10+ new master-planned communities. As home values continue to escalate, the median single famliy home price is up 24.4% and condo/townhome prices are up 21.8% in April 2021 over April 2020. Single-family home inventory is down 39% while condo and townhome inventory are down 56%!!!!!! Residential real estate closings were down 11% compared February 2021 to February 2022 and new listings were down 16%, while the sales of homes priced over $1.0 million were up 38%. wolfstreet sees distortions spike buyers Compare that with the current United States inflation rate of 1.7%, and that means housing is actually becoming cheaper in comparison. The economy in San Diego is just too strong. Experts agree that you shouldnt wait to find your new great home just to get an excellent deal on a house. May's closings will most likely reflect an 18-20% decline with pending sales down 18.9% and condos/townhomes down 18.7%. Also, housing bubbles tend to crash fast and dramatically. Plus, there are several other major companies with offices in San Diego, including Amazon, Walmart, FedEx, IBM, CVS Health, Siemens, AT&T, PepsiCo, Wells Fargo, and many more. JUST UPDATED: San Diegos 7 Best Places to Live in 2022 | 2023.

Due to the inherent time lag from a buyer's offer acceptance to a successful close of escrow, we are unlikely to see any significant statistical changes in the market until later in Q3. 5 Reasons Why It Wont Crash in 2022 | 2023. kawan February 2020 we had 2 months of inventory and now we have less than three weeks of inventory on single family homes. To really tell, you have to look at how inflated the house prices are in comparison to the economy. However, back in the 2000s, banks began relaxing their policies. Single family home inventory increased 20% for single family & 10% condos/townhomes. Single family median price was up 15.2% $102,877 and the median price for condos and townhomes were up 14.7%. The average active market time was 21 days down 16%. Single family homes inventory is around three weeks with condos and townhomes at one month. Month's supply of inventory is down another 10 basis points from March 2021. Regionally we are trying to see more investors come in and create more housing developments, Roxas said. San Diego's resale real estate market is up 10% over last year.

Due to the inherent time lag from a buyer's offer acceptance to a successful close of escrow, we are unlikely to see any significant statistical changes in the market until later in Q3. 5 Reasons Why It Wont Crash in 2022 | 2023. kawan February 2020 we had 2 months of inventory and now we have less than three weeks of inventory on single family homes. To really tell, you have to look at how inflated the house prices are in comparison to the economy. However, back in the 2000s, banks began relaxing their policies. Single family home inventory increased 20% for single family & 10% condos/townhomes. Single family median price was up 15.2% $102,877 and the median price for condos and townhomes were up 14.7%. The average active market time was 21 days down 16%. Single family homes inventory is around three weeks with condos and townhomes at one month. Month's supply of inventory is down another 10 basis points from March 2021. Regionally we are trying to see more investors come in and create more housing developments, Roxas said. San Diego's resale real estate market is up 10% over last year.  With a lower unemployment rate, even more expensive housing options become more affordable. During the first four months of 2021San Diego new homebuilding permits are up 27% from 2020. I think we are already seeing signs of the market cooling off right now to be completely honest. Before the 2008 crash, housing prices increased exponentially. Median sales prices were up 15.1% for single family with a 5% decrease in days on market and sales prices up 22.3% for condos/townhomes with a 11.1% decrease in days on market . If the MAI drops consistently or falls into the Buyers zone, watch for downward pressure on prices. Specifically, if housing was so unaffordable, then how come people were able to still buy homes and drive up the prices? But why are housing prices only growing moderately?

With a lower unemployment rate, even more expensive housing options become more affordable. During the first four months of 2021San Diego new homebuilding permits are up 27% from 2020. I think we are already seeing signs of the market cooling off right now to be completely honest. Before the 2008 crash, housing prices increased exponentially. Median sales prices were up 15.1% for single family with a 5% decrease in days on market and sales prices up 22.3% for condos/townhomes with a 11.1% decrease in days on market . If the MAI drops consistently or falls into the Buyers zone, watch for downward pressure on prices. Specifically, if housing was so unaffordable, then how come people were able to still buy homes and drive up the prices? But why are housing prices only growing moderately?  Interest rate increases will result in more cash buyers that have been on the sidelines and foreign buyers. Volume-wise the markets remain strong: expecting a repeat of 2021 seems irrational as interest rates rise rather notably, but higher prices should compensate dollar-volume-wise. Though housing prices have increased significantly and are above pre-2008 levels, the economy is in San Diego is much stronger and able to support those higher housing prices. Now contrast pre-2008 to now. While most homebuyers could not purchase the undervalued homes at that time, when the recession ended in 2009 and the economy began strengthening, more people started buying houses. *Be sure toregister for a free accountso that you can receive email updates whenever new San Diego properties come on the marketand if you're in the market for a home today, reach out for ourexclusive off MLS pocket listings! Rates will move another leg higher if the 10-year moves back above 3%. When looking at inventory we have around one month of supply rather than what's typical, multiple months. EXPOSED: The Real San Diego Cost of Living Guide in 2022 | 2023. Furthermore, as more people became unemployed until the unemployment rate reached 10% in 2012, the housing prices dropped even more. Communities where you know the interest payment is a big part of their budget will be particularly hard hit. This is called sub-prime lending. There were 22 new listings down 18.5%, There were 5 total pending sales down 66.7%and 11 total sold condos down 8.3%, The average sales price in this price band $3M-$4M condos is down 6.8%. The market plateau is seen across the price and value. In fact, the consumer price index in September 2019 said that most consumer goods increased in cost by 2.4% over the previous year. January through May the sales of single-family homes were up 26% while condos and townhome sales are up 44%. The rise in housing prices is good and healthy. VISIT: San Diegos 10 Most Affordable Neighborhoods in 2022 | 2023.

Interest rate increases will result in more cash buyers that have been on the sidelines and foreign buyers. Volume-wise the markets remain strong: expecting a repeat of 2021 seems irrational as interest rates rise rather notably, but higher prices should compensate dollar-volume-wise. Though housing prices have increased significantly and are above pre-2008 levels, the economy is in San Diego is much stronger and able to support those higher housing prices. Now contrast pre-2008 to now. While most homebuyers could not purchase the undervalued homes at that time, when the recession ended in 2009 and the economy began strengthening, more people started buying houses. *Be sure toregister for a free accountso that you can receive email updates whenever new San Diego properties come on the marketand if you're in the market for a home today, reach out for ourexclusive off MLS pocket listings! Rates will move another leg higher if the 10-year moves back above 3%. When looking at inventory we have around one month of supply rather than what's typical, multiple months. EXPOSED: The Real San Diego Cost of Living Guide in 2022 | 2023. Furthermore, as more people became unemployed until the unemployment rate reached 10% in 2012, the housing prices dropped even more. Communities where you know the interest payment is a big part of their budget will be particularly hard hit. This is called sub-prime lending. There were 22 new listings down 18.5%, There were 5 total pending sales down 66.7%and 11 total sold condos down 8.3%, The average sales price in this price band $3M-$4M condos is down 6.8%. The market plateau is seen across the price and value. In fact, the consumer price index in September 2019 said that most consumer goods increased in cost by 2.4% over the previous year. January through May the sales of single-family homes were up 26% while condos and townhome sales are up 44%. The rise in housing prices is good and healthy. VISIT: San Diegos 10 Most Affordable Neighborhoods in 2022 | 2023.  While this worked in the short-term, it eroded all financial foundations.

While this worked in the short-term, it eroded all financial foundations.  Furthermore, housing prices are expected to only increase by another 1.5% in the next year. Read Now: 7 San Diego Beach Towns to Buy a Home in. July 1st 2022As expected interest rate increases are to blame for San Diego real estate sales down one-third year over year. Search for newly listed homes, open houses, recently sold homes, and recent price reductions in San Diego County. More than 1.7 million units of new single family residences, condos, and apartments were underway in 2021 with the highest production level since the last great recession. We will know more this fall if we may have plateaued when kids are back in school and the market normally cools a bit from the summer. Single family homes in San Diego had an inventory increase of 25% with a 6% increase for condos/townhomes. If someone has a good credit history, they are more likely to get approved with a lower interest rate. Home values appreciating quickly in other areas are causing some buyers to head to San Diego. San Diego unemployment rate ended 2021 at 4.2% with leisure and hospitality and professional and business services leading the way. Luckily, many people have explored in detail the factors that lead to the 2008 crash, which was the largest crash since the Great Depression. How could the housing prices increase so much before 2008? Those who have questions or need information about San Diegos real estate leave me a comment below or, contact me here. surging 33.3% in August 7-percentage points faster than San Diego. San Diego buyers are worried are they are buying at the top? As of December 4th nationwide initial job claims were 184,000, virtually the same as pre-COVID (a great indicator of the overall economy) San Diego County is up 61,600 jobs since last October with leisure and hospitality jobs still lagging pre-Covid levels. READ: San Diego vs Los Angeles: Which SoCal City is Best in 2022 | 2023? June 5th 2022Increasing inflation, soaring home prices, mortgage interest rates moving up to 6% (and over depending on the loan product), and declines in both the stock and cryptocurrency markets have caused a nationwide cooling of demand. There were 43 total pending sales down 21.8% and 53 total sold up 23.3%. Specifically, when it came to approving mortgages, they started to approve people who didnt pass all their rigorous financial checks. 8% for single-family homes and 39% for condos and multifamily rental units. LUXURYSOCALREALTY - San Diego Real Estate, The average total market time was 19 days up 17.6%. With pending sales down, February closings will be much lower than in years past. Buyers should be ready to take advantage of a slowing market and sellers it's more important than ever to prepare your home to shine in it's best light and price correctly. Lumber prices have increased to more than $1,000 per 1,000 board feet from $300 per 1,000 board feet.

Furthermore, housing prices are expected to only increase by another 1.5% in the next year. Read Now: 7 San Diego Beach Towns to Buy a Home in. July 1st 2022As expected interest rate increases are to blame for San Diego real estate sales down one-third year over year. Search for newly listed homes, open houses, recently sold homes, and recent price reductions in San Diego County. More than 1.7 million units of new single family residences, condos, and apartments were underway in 2021 with the highest production level since the last great recession. We will know more this fall if we may have plateaued when kids are back in school and the market normally cools a bit from the summer. Single family homes in San Diego had an inventory increase of 25% with a 6% increase for condos/townhomes. If someone has a good credit history, they are more likely to get approved with a lower interest rate. Home values appreciating quickly in other areas are causing some buyers to head to San Diego. San Diego unemployment rate ended 2021 at 4.2% with leisure and hospitality and professional and business services leading the way. Luckily, many people have explored in detail the factors that lead to the 2008 crash, which was the largest crash since the Great Depression. How could the housing prices increase so much before 2008? Those who have questions or need information about San Diegos real estate leave me a comment below or, contact me here. surging 33.3% in August 7-percentage points faster than San Diego. San Diego buyers are worried are they are buying at the top? As of December 4th nationwide initial job claims were 184,000, virtually the same as pre-COVID (a great indicator of the overall economy) San Diego County is up 61,600 jobs since last October with leisure and hospitality jobs still lagging pre-Covid levels. READ: San Diego vs Los Angeles: Which SoCal City is Best in 2022 | 2023? June 5th 2022Increasing inflation, soaring home prices, mortgage interest rates moving up to 6% (and over depending on the loan product), and declines in both the stock and cryptocurrency markets have caused a nationwide cooling of demand. There were 43 total pending sales down 21.8% and 53 total sold up 23.3%. Specifically, when it came to approving mortgages, they started to approve people who didnt pass all their rigorous financial checks. 8% for single-family homes and 39% for condos and multifamily rental units. LUXURYSOCALREALTY - San Diego Real Estate, The average total market time was 19 days up 17.6%. With pending sales down, February closings will be much lower than in years past. Buyers should be ready to take advantage of a slowing market and sellers it's more important than ever to prepare your home to shine in it's best light and price correctly. Lumber prices have increased to more than $1,000 per 1,000 board feet from $300 per 1,000 board feet.

The real estate market forecast shows signs of a somewhat slower bloom. This is less than last month's market action index of 85. Inventory has been climbing lately. Thats well below Californias unemployment rate of 4% and the United States unemployment rate of 3.6%. We have practically zero Foreclosures. Residential new construction for San Diego in 2022 will add approximately 9,000 housing units. Though housing prices are increasing, they are following the increase in income. Housing prices are growing slowly but steadily, Price increases are below the inflation rate, San Diego has a thriving small business community. There are many factors fueling the hot housing market, according to economists. Accounts of less crowded open houses, fewer private showing requests, longer days on market, and fewer offers on new listings are becoming more common. I only see it expanding. Just behind Los Angeles, San Diego came in 6th place for venture capital funding.

The real estate market forecast shows signs of a somewhat slower bloom. This is less than last month's market action index of 85. Inventory has been climbing lately. Thats well below Californias unemployment rate of 4% and the United States unemployment rate of 3.6%. We have practically zero Foreclosures. Residential new construction for San Diego in 2022 will add approximately 9,000 housing units. Though housing prices are increasing, they are following the increase in income. Housing prices are growing slowly but steadily, Price increases are below the inflation rate, San Diego has a thriving small business community. There are many factors fueling the hot housing market, according to economists. Accounts of less crowded open houses, fewer private showing requests, longer days on market, and fewer offers on new listings are becoming more common. I only see it expanding. Just behind Los Angeles, San Diego came in 6th place for venture capital funding.  The absorption rate is down 65.7% at 2.3 months.

The absorption rate is down 65.7% at 2.3 months.  Despite an expected cooldown in the market, experts believe the foundation of the San Diego housing market will remain strong. A good deal is a good deal, and you should take it. At the end of April San Diego had 3,270 single-family homes and condo/townhomes pending at an increase of one-third over April 2020. Furthermore, since historically a bubble has burst every 13 years, you might expect us to be due for another one in the next several years. It's unlikely San Diego housing prices will drop next year in 2022 and highly likely prices will have increased over 10% from 2021. It's expected mortgage interest rates will be 3.75%-4% by the end of 2022. New listings were down as homeowners were in a wait and see freeze. If the MAI begins to climb, prices will likely follow suit. Single family home inventory is down nearly a half from 2021 while condo/townhome inventory is down 60%. This was an increase of 1.4 percent since January. This is less than last month's market action index of 70.

Despite an expected cooldown in the market, experts believe the foundation of the San Diego housing market will remain strong. A good deal is a good deal, and you should take it. At the end of April San Diego had 3,270 single-family homes and condo/townhomes pending at an increase of one-third over April 2020. Furthermore, since historically a bubble has burst every 13 years, you might expect us to be due for another one in the next several years. It's unlikely San Diego housing prices will drop next year in 2022 and highly likely prices will have increased over 10% from 2021. It's expected mortgage interest rates will be 3.75%-4% by the end of 2022. New listings were down as homeowners were in a wait and see freeze. If the MAI begins to climb, prices will likely follow suit. Single family home inventory is down nearly a half from 2021 while condo/townhome inventory is down 60%. This was an increase of 1.4 percent since January. This is less than last month's market action index of 70.  Condo, townhouse, and rowhome inventory has halved in the past year. Single family detached homes are up 20.7% with a median price of $875,000 and attached condos, townhomes, and rowhomes are up 17.8% with the median price of $530,000. Researchreal estate market trendsand findSan Diego real estate. Among many other things, banks and other financial institutions began risky lending practices. Primarily inNorthCounty San Diego, there will be 10+ new master-planned communities. As home values continue to escalate, the median single famliy home price is up 24.4% and condo/townhome prices are up 21.8% in April 2021 over April 2020. Single-family home inventory is down 39% while condo and townhome inventory are down 56%!!!!!! Residential real estate closings were down 11% compared February 2021 to February 2022 and new listings were down 16%, while the sales of homes priced over $1.0 million were up 38%. wolfstreet sees distortions spike buyers Compare that with the current United States inflation rate of 1.7%, and that means housing is actually becoming cheaper in comparison. The economy in San Diego is just too strong. Experts agree that you shouldnt wait to find your new great home just to get an excellent deal on a house. May's closings will most likely reflect an 18-20% decline with pending sales down 18.9% and condos/townhomes down 18.7%. Also, housing bubbles tend to crash fast and dramatically. Plus, there are several other major companies with offices in San Diego, including Amazon, Walmart, FedEx, IBM, CVS Health, Siemens, AT&T, PepsiCo, Wells Fargo, and many more. JUST UPDATED: San Diegos 7 Best Places to Live in 2022 | 2023.

Condo, townhouse, and rowhome inventory has halved in the past year. Single family detached homes are up 20.7% with a median price of $875,000 and attached condos, townhomes, and rowhomes are up 17.8% with the median price of $530,000. Researchreal estate market trendsand findSan Diego real estate. Among many other things, banks and other financial institutions began risky lending practices. Primarily inNorthCounty San Diego, there will be 10+ new master-planned communities. As home values continue to escalate, the median single famliy home price is up 24.4% and condo/townhome prices are up 21.8% in April 2021 over April 2020. Single-family home inventory is down 39% while condo and townhome inventory are down 56%!!!!!! Residential real estate closings were down 11% compared February 2021 to February 2022 and new listings were down 16%, while the sales of homes priced over $1.0 million were up 38%. wolfstreet sees distortions spike buyers Compare that with the current United States inflation rate of 1.7%, and that means housing is actually becoming cheaper in comparison. The economy in San Diego is just too strong. Experts agree that you shouldnt wait to find your new great home just to get an excellent deal on a house. May's closings will most likely reflect an 18-20% decline with pending sales down 18.9% and condos/townhomes down 18.7%. Also, housing bubbles tend to crash fast and dramatically. Plus, there are several other major companies with offices in San Diego, including Amazon, Walmart, FedEx, IBM, CVS Health, Siemens, AT&T, PepsiCo, Wells Fargo, and many more. JUST UPDATED: San Diegos 7 Best Places to Live in 2022 | 2023.