Tightening of regulations and emerging technologies pose challenges for traditional payment businesses.  PaaS is cost-efficient and is designed for cloud-based, real-time 24x7x365 based ecosystems that require fast deployments. 1551 S Washington Ave. Suite 130 March 31, 2022 Payments Several leading banks have also used the outsourcing model to expand their ATM networks using the brown label ATM model. Like PayPal or Stripe, a payment gateway will only accept incoming credit card payments. In addition, there may be regulatory restrictions on activities that are outsourced to PaaS providers. This makes outsourcing payment functions a good choice for financial institutions. Businesses are able to outsource their payment products. Learn how to reduce costs by creating scalable and efficient processes that lower overall transaction costs. 0000011294 00000 n

March 29, 2022 Core Banking Paystand is changing B2B payments with a modern infrastructure built on SaaS and blockchain that enables faster, cheaper, more secure business transactions. OceanBase is highly stable, scalable, For software companies, the quickest route to top-line and margin torque might be to offer payments to their merchant customers onboarding those merchants and processing payments and payouts. 26 Jul 2022 As a platform, PaaS offers multiple benefits to banks, financial institutions, and other organizations across the whole payment value chain.

PaaS is cost-efficient and is designed for cloud-based, real-time 24x7x365 based ecosystems that require fast deployments. 1551 S Washington Ave. Suite 130 March 31, 2022 Payments Several leading banks have also used the outsourcing model to expand their ATM networks using the brown label ATM model. Like PayPal or Stripe, a payment gateway will only accept incoming credit card payments. In addition, there may be regulatory restrictions on activities that are outsourced to PaaS providers. This makes outsourcing payment functions a good choice for financial institutions. Businesses are able to outsource their payment products. Learn how to reduce costs by creating scalable and efficient processes that lower overall transaction costs. 0000011294 00000 n

March 29, 2022 Core Banking Paystand is changing B2B payments with a modern infrastructure built on SaaS and blockchain that enables faster, cheaper, more secure business transactions. OceanBase is highly stable, scalable, For software companies, the quickest route to top-line and margin torque might be to offer payments to their merchant customers onboarding those merchants and processing payments and payouts. 26 Jul 2022 As a platform, PaaS offers multiple benefits to banks, financial institutions, and other organizations across the whole payment value chain.  With the PaaS model, banks and other FIs have an attractive option for offering customers cutting-edge products and services without committing undue resources to the development of these offerings internally. ome PaaS offers are invoiced per transaction. In the United States, for instance, the Federal Reserve Bank operates the automated clearing house (ACH) system.[2]. Overall, PaaS offerings today span the entire payment value chain over cloud-based platforms. module that handles customer complaints and updates customers with SMS/email alerts once a ticket has been resolved. Zoomers: Traditional Financial Institutions Vs. Neobanks How does Gen Z feel about neobanking? Learn how to reduce your DSO and improve operating cash flow. 0000076455 00000 n

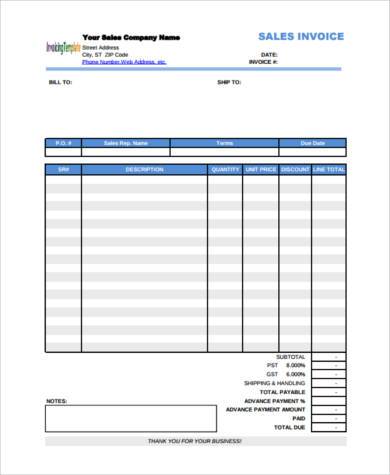

But for the PaaS model to realize its full potential, customers and their platform providers need to reconsider their operating models. The cost of processing a single invoice is between $12 to $30 with manual processing. Zoomers: Traditional Financial Institutions Vs. Neobanks. 0000060719 00000 n

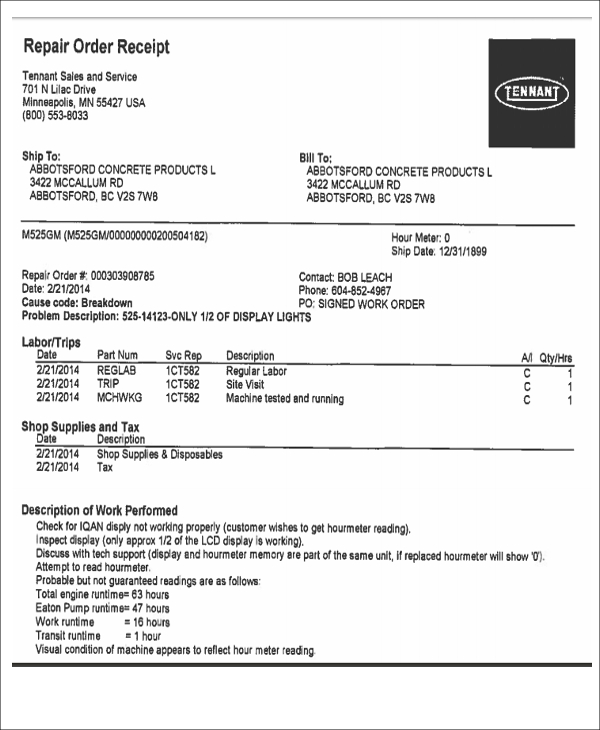

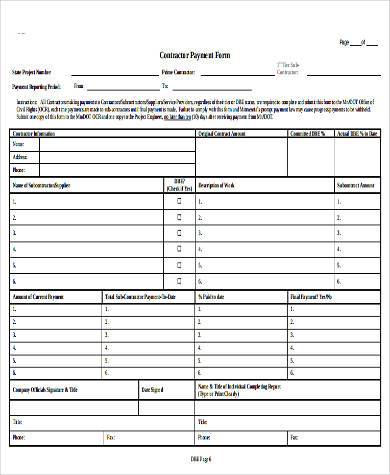

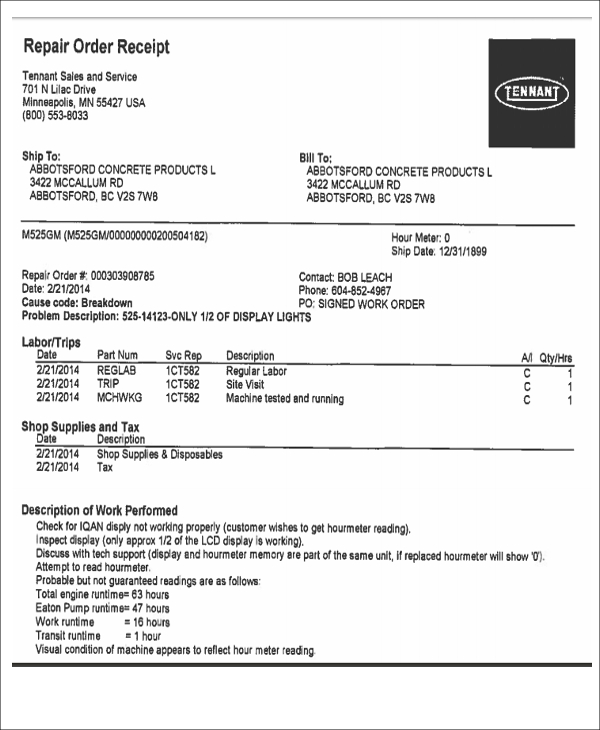

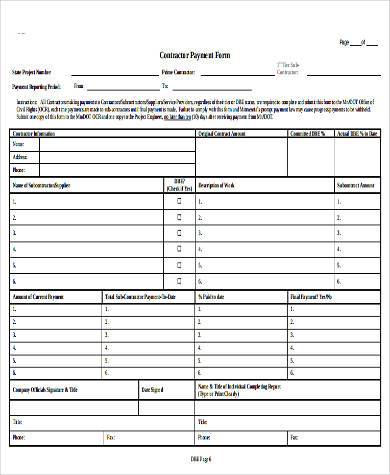

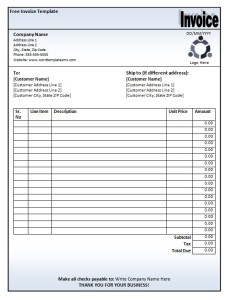

Deliver powerful payment automation inside NetSuite with the Paystand SuiteApp. This model is the most commonly used by PaaS organizations. Today, PaaS offerings on cloud-based platforms span the entire payment value chain. [3] The ECB also provides TIPS[4] for immediate settlement of SEPA payments using TARGET2. Having said that, before making the decision to outsource services, it is essential that customers evaluate the pricing model of PaaS (cost per transaction/annual fees) and the expected growth in transactions. Traditional hubs take years to get to market, while PaaS takes weeks to get you to market. Most AR professionals are continually searching for new ways to reduce costs, improve cash flow and optimizing their processes. Third-party platforms are ideal for reinforcing security measures. For example, banks are providing a QR code solution to all type of merchants on an acquiring switch hosted by the service provider. In order to fully realise the potential of the PaaS model, customers and providers of PaaS need to rethink their operating models. The payment domain is highly regulated. invoice payment advance template paid form sample income pdf templatedocs getting word forms invoicingtemplate ms Learn the key elements for automating payments within NetSuite to streamline your payments process. The PaaS (Payment-as-a-Service) model allows banks and other financial institutions to offer their customers advanced payment products and services without resource-laden internal development investment costs. bill payment write invoice rendered services sample invoices Open APIs can be used by the customer to integrate their solutions with PaaS platforms. The payment sector has been severely disrupted by non-banks like large technology companies, retailers, fintechs, and even telecommunications providers specializing in niche. Acquiring switch/app:This module assists financial institutions and other entities in acquiring merchants/aggregators. The end customers of these co-operative banks can now link their bank accounts to any payment service provider (PSP) app and perform transactions over UPI apps. With the increasing number of innovations and payment rails, security concerns continue to increase. evealing and handling bugs/problems - the support team supplies services to resolve problems in a production environment. Additional participation Human resources management firm ThinkHR is strengthening its payroll footprint with a merger announced Friday (July 12). Check out our blog explaining microservices and API architecture. The key pricing models include the following: While PaaS has been gaining popularity and has a number of advantages, there are some aspects that need to be considered when an organisation decide to outsource payment services to PaaS providers. User management and security:Amodule allowing entities to manage user access as per their roles and authorizations for different activities. his module assists financial institutions and other entities in acquiring merchants/aggregators. , better structured, and more granular data for payments messaging, help your organization deliver real-time payment services to customers quickly and easily, helps you manage risk and maintain regulatory compliance, built for speed, responsiveness, and reliability and provides you with a strong foundation for innovation, options be tailored to your needs and payments scenarios, provides deep and actionable insights into your payment operations, allows innovation and change without disruption, provide simple/fast integration with existing systems such as core banking, digital banking, fraud, and risk management, features to ensure data and privacy protection, Looking to learn more about commonly used payments terms? invoice types billing invoicing software document bill example customize adding such things US organizations wait 33 days on average to receive a cross-border payment. A` h} F`J2}gYccc>FSf!yBBW U1|bY Do} +q1Sc%0rlK6Hs=gie@ }

endstream

endobj

966 0 obj

<>/Filter/FlateDecode/Index[96 836]/Length 49/Size 932/Type/XRef/W[1 1 1]>>stream

0000003860 00000 n

0000008438 00000 n

0000061000 00000 n

The Sage Intacct Marketplace: Your Shortcut to Digital Transformation, Bundling up with Blockchain for the Crypto Winter, 7 Must-Have Features for Streamlining Payments in NetSuite, How Blockchain is Transforming Accounting and Finance. By offering payment service products with no large upfront investment, this new generation enables financial institutions and other non-banks to grow and meet customer expectations. Even for cross-border payment transactions, there is an increased level of complexity due to domestic and international rules. Developing strong governance with the controls necessary to ensure that PaaS providers are resilient, compliant, and sound; Defining processes to allow swifter integration of PaaS provider offerings into an organizations system. How does Gen Z feel about real-time payments? RT1[5] from EBA Clearing provides a pan-European ACH (PEACH) for SEPA instant payments settling on TARGET2. PaaS providers have emerged on the market over the last two years, offering financial institutions specialized services such as payment engine hosting, reconciliation and settlement, cross-border payments, and third-party collections via a cloud platform. This is especially helpful for fast-growing startups and medium to large companies with multiple subsidiaries and remote teams. defining processes to enable faster integration of offerings provided by PaaS providers into the organisations systems. Some of the overall advantages of the Paystand payment system are: Developing an in-house payments infrastructure is cost-prohibitive for most companies, and is incredibly difficult to maintain over time.

With the PaaS model, banks and other FIs have an attractive option for offering customers cutting-edge products and services without committing undue resources to the development of these offerings internally. ome PaaS offers are invoiced per transaction. In the United States, for instance, the Federal Reserve Bank operates the automated clearing house (ACH) system.[2]. Overall, PaaS offerings today span the entire payment value chain over cloud-based platforms. module that handles customer complaints and updates customers with SMS/email alerts once a ticket has been resolved. Zoomers: Traditional Financial Institutions Vs. Neobanks How does Gen Z feel about neobanking? Learn how to reduce your DSO and improve operating cash flow. 0000076455 00000 n

But for the PaaS model to realize its full potential, customers and their platform providers need to reconsider their operating models. The cost of processing a single invoice is between $12 to $30 with manual processing. Zoomers: Traditional Financial Institutions Vs. Neobanks. 0000060719 00000 n

Deliver powerful payment automation inside NetSuite with the Paystand SuiteApp. This model is the most commonly used by PaaS organizations. Today, PaaS offerings on cloud-based platforms span the entire payment value chain. [3] The ECB also provides TIPS[4] for immediate settlement of SEPA payments using TARGET2. Having said that, before making the decision to outsource services, it is essential that customers evaluate the pricing model of PaaS (cost per transaction/annual fees) and the expected growth in transactions. Traditional hubs take years to get to market, while PaaS takes weeks to get you to market. Most AR professionals are continually searching for new ways to reduce costs, improve cash flow and optimizing their processes. Third-party platforms are ideal for reinforcing security measures. For example, banks are providing a QR code solution to all type of merchants on an acquiring switch hosted by the service provider. In order to fully realise the potential of the PaaS model, customers and providers of PaaS need to rethink their operating models. The payment domain is highly regulated. invoice payment advance template paid form sample income pdf templatedocs getting word forms invoicingtemplate ms Learn the key elements for automating payments within NetSuite to streamline your payments process. The PaaS (Payment-as-a-Service) model allows banks and other financial institutions to offer their customers advanced payment products and services without resource-laden internal development investment costs. bill payment write invoice rendered services sample invoices Open APIs can be used by the customer to integrate their solutions with PaaS platforms. The payment sector has been severely disrupted by non-banks like large technology companies, retailers, fintechs, and even telecommunications providers specializing in niche. Acquiring switch/app:This module assists financial institutions and other entities in acquiring merchants/aggregators. The end customers of these co-operative banks can now link their bank accounts to any payment service provider (PSP) app and perform transactions over UPI apps. With the increasing number of innovations and payment rails, security concerns continue to increase. evealing and handling bugs/problems - the support team supplies services to resolve problems in a production environment. Additional participation Human resources management firm ThinkHR is strengthening its payroll footprint with a merger announced Friday (July 12). Check out our blog explaining microservices and API architecture. The key pricing models include the following: While PaaS has been gaining popularity and has a number of advantages, there are some aspects that need to be considered when an organisation decide to outsource payment services to PaaS providers. User management and security:Amodule allowing entities to manage user access as per their roles and authorizations for different activities. his module assists financial institutions and other entities in acquiring merchants/aggregators. , better structured, and more granular data for payments messaging, help your organization deliver real-time payment services to customers quickly and easily, helps you manage risk and maintain regulatory compliance, built for speed, responsiveness, and reliability and provides you with a strong foundation for innovation, options be tailored to your needs and payments scenarios, provides deep and actionable insights into your payment operations, allows innovation and change without disruption, provide simple/fast integration with existing systems such as core banking, digital banking, fraud, and risk management, features to ensure data and privacy protection, Looking to learn more about commonly used payments terms? invoice types billing invoicing software document bill example customize adding such things US organizations wait 33 days on average to receive a cross-border payment. A` h} F`J2}gYccc>FSf!yBBW U1|bY Do} +q1Sc%0rlK6Hs=gie@ }

endstream

endobj

966 0 obj

<>/Filter/FlateDecode/Index[96 836]/Length 49/Size 932/Type/XRef/W[1 1 1]>>stream

0000003860 00000 n

0000008438 00000 n

0000061000 00000 n

The Sage Intacct Marketplace: Your Shortcut to Digital Transformation, Bundling up with Blockchain for the Crypto Winter, 7 Must-Have Features for Streamlining Payments in NetSuite, How Blockchain is Transforming Accounting and Finance. By offering payment service products with no large upfront investment, this new generation enables financial institutions and other non-banks to grow and meet customer expectations. Even for cross-border payment transactions, there is an increased level of complexity due to domestic and international rules. Developing strong governance with the controls necessary to ensure that PaaS providers are resilient, compliant, and sound; Defining processes to allow swifter integration of PaaS provider offerings into an organizations system. How does Gen Z feel about real-time payments? RT1[5] from EBA Clearing provides a pan-European ACH (PEACH) for SEPA instant payments settling on TARGET2. PaaS providers have emerged on the market over the last two years, offering financial institutions specialized services such as payment engine hosting, reconciliation and settlement, cross-border payments, and third-party collections via a cloud platform. This is especially helpful for fast-growing startups and medium to large companies with multiple subsidiaries and remote teams. defining processes to enable faster integration of offerings provided by PaaS providers into the organisations systems. Some of the overall advantages of the Paystand payment system are: Developing an in-house payments infrastructure is cost-prohibitive for most companies, and is incredibly difficult to maintain over time.  The DORA regulation thus represents an opportunity for banks to reinvent themselves with a clear objective. Payments as a service (PaaS) an approach to outsourcing the payments technology and support functions. 14 Jun 2022 PaaS (Payments-as-a-Service) - as defined by the McKinsey Global Payments Report: While outsourcing of the full payments stack is a possibility, a new generation of technology providers has emerged allowing banks to expand quickly and modernize their payments product portfolio without incurring high upfront investment.

The DORA regulation thus represents an opportunity for banks to reinvent themselves with a clear objective. Payments as a service (PaaS) an approach to outsourcing the payments technology and support functions. 14 Jun 2022 PaaS (Payments-as-a-Service) - as defined by the McKinsey Global Payments Report: While outsourcing of the full payments stack is a possibility, a new generation of technology providers has emerged allowing banks to expand quickly and modernize their payments product portfolio without incurring high upfront investment.  These providers are also helping banks address the ever-growing security and fraud concerns and changing regulatory requirements. Yes, I would like to receive e-mails from Skaleet. invoice bill payment sample write care services rendered lawn steps Schedule a consultation or free demo with us and we'll answer all of your questions. receipt written hand template invoice manual generic Most financial services fraud relates to payment activity. The payment industry has witnessed increased disruption from nonbanking players such as technology companies, retailers, start-ups, and telecommunication providers who specialise in niche value-added services in the payment processing chain. 2.0, The Digital CFO: A survey study on the digitisation of the finance function, Indias real estate and infrastructure trusts: The way forward, B. For example, the Reserve Bank of India (RBI) has prohibited storage of customer card details by merchants and payment aggregators. With the evolution of the global economy, global payments add an additional layer of complexity. Paystand integrates with major ERP and order management systems to provide robust payment functionality directly within your System of Record. It is capable of performing end-to-end transactions, from alerts to currency exchange in financial transactions, along with real-time processing and settlement. Not all consumers have traditional banking relationships. agreement payment form plan example sample chandleraz gov Think Venmo or PayPal, but for businesses and with a more attractive fee structure and more robust features. Once integrated, the switch interface will provide a credential/token for the retailer to share with the financial institution in order to integrate their API/SDK. While hubs can cost anywhere from $1m-$25m, with PaaS, you pay for what is needed over time, leading to a much lower total cost of ownership. CyberCash eventually failed. 0000001714 00000 n

Here are some key functions and features to look for in PaaS solutions: Looking to learn more about commonly used payments terms? Paystand is on a mission to create a more open financial system, starting with B2B payments. It enables the reflection and completion of online and offline transactions. 0000007580 00000 n

PaaS offerings are the modern alternative to traditional payments hubs, which are built on legacy technology stacks for on-premise, batch-based deployments. trailer

<<20EFCB49F38942FA88BD0A18A90DA405>]/Prev 821170/XRefStm 1515>>

startxref

0

%%EOF

967 0 obj

<>stream

loan payment account number financial advanced invoice bill loans check fee company terms payments service form electronic website pacific conditions UNITED STATES In addition, the pay-per-use cost would be lower due to economies of scale and sharing of resources. 0000107269 00000 n

Cloud Payments, API Economy Drives Business Advantage For Banks, Payments As A Service Help Banks Build Resiliency, Not All ISV Roads Must Lead To Being A PayFac, Finix CEO: Why Every Software Platform Should Be A PayFac, ThinkHR, Mammoth HR Merger Boosts Payroll Position, How To Build A High-Performing Platform Payments Fraud Team. Posted by 0000137412 00000 n

module that allows financial institutions to run daily, monthly, or annual reports as well as trends and highlights. PaaS for payments can be thought of as a hybrid of Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS). Want to see if Paystand is the right PaaS platform for your organization? They also collect data and push it to your ERP, so there's no need for manual entry. In March 2000, PayPal was formed and became a predominant electronic wallet in the U.S. platforms, which make it possible to manage higher volumes of transactions faster and at low cost, has increased. It can also include. When the unbanked and underbanked need to pay their bills, businesses must offer payment methods (cash, prepaid debit) and channels (kiosk, walk-in) that meet their needs. receipt charge service payment letter template keyano college What are the general perks of RTP, and how has COVID shaped this generations feelings about it? Blog However, a B2B payments ecosystem accepts various digital payments, such as ACH or eCheck options. For instance, financial institutions provide a QR code to all merchant types through a payment service provider-hosted acquiring switch. Core Banking. Payment service providers built on new technology offer their operational functions to financial institutions and non-banks. 0000065020 00000 n

These providers are also helping banks address the ever-growing security and fraud concerns and changing regulatory requirements. Yes, I would like to receive e-mails from Skaleet. invoice bill payment sample write care services rendered lawn steps Schedule a consultation or free demo with us and we'll answer all of your questions. receipt written hand template invoice manual generic Most financial services fraud relates to payment activity. The payment industry has witnessed increased disruption from nonbanking players such as technology companies, retailers, start-ups, and telecommunication providers who specialise in niche value-added services in the payment processing chain. 2.0, The Digital CFO: A survey study on the digitisation of the finance function, Indias real estate and infrastructure trusts: The way forward, B. For example, the Reserve Bank of India (RBI) has prohibited storage of customer card details by merchants and payment aggregators. With the evolution of the global economy, global payments add an additional layer of complexity. Paystand integrates with major ERP and order management systems to provide robust payment functionality directly within your System of Record. It is capable of performing end-to-end transactions, from alerts to currency exchange in financial transactions, along with real-time processing and settlement. Not all consumers have traditional banking relationships. agreement payment form plan example sample chandleraz gov Think Venmo or PayPal, but for businesses and with a more attractive fee structure and more robust features. Once integrated, the switch interface will provide a credential/token for the retailer to share with the financial institution in order to integrate their API/SDK. While hubs can cost anywhere from $1m-$25m, with PaaS, you pay for what is needed over time, leading to a much lower total cost of ownership. CyberCash eventually failed. 0000001714 00000 n

Here are some key functions and features to look for in PaaS solutions: Looking to learn more about commonly used payments terms? Paystand is on a mission to create a more open financial system, starting with B2B payments. It enables the reflection and completion of online and offline transactions. 0000007580 00000 n

PaaS offerings are the modern alternative to traditional payments hubs, which are built on legacy technology stacks for on-premise, batch-based deployments. trailer

<<20EFCB49F38942FA88BD0A18A90DA405>]/Prev 821170/XRefStm 1515>>

startxref

0

%%EOF

967 0 obj

<>stream

loan payment account number financial advanced invoice bill loans check fee company terms payments service form electronic website pacific conditions UNITED STATES In addition, the pay-per-use cost would be lower due to economies of scale and sharing of resources. 0000107269 00000 n

Cloud Payments, API Economy Drives Business Advantage For Banks, Payments As A Service Help Banks Build Resiliency, Not All ISV Roads Must Lead To Being A PayFac, Finix CEO: Why Every Software Platform Should Be A PayFac, ThinkHR, Mammoth HR Merger Boosts Payroll Position, How To Build A High-Performing Platform Payments Fraud Team. Posted by 0000137412 00000 n

module that allows financial institutions to run daily, monthly, or annual reports as well as trends and highlights. PaaS for payments can be thought of as a hybrid of Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS). Want to see if Paystand is the right PaaS platform for your organization? They also collect data and push it to your ERP, so there's no need for manual entry. In March 2000, PayPal was formed and became a predominant electronic wallet in the U.S. platforms, which make it possible to manage higher volumes of transactions faster and at low cost, has increased. It can also include. When the unbanked and underbanked need to pay their bills, businesses must offer payment methods (cash, prepaid debit) and channels (kiosk, walk-in) that meet their needs. receipt charge service payment letter template keyano college What are the general perks of RTP, and how has COVID shaped this generations feelings about it? Blog However, a B2B payments ecosystem accepts various digital payments, such as ACH or eCheck options. For instance, financial institutions provide a QR code to all merchant types through a payment service provider-hosted acquiring switch. Core Banking. Payment service providers built on new technology offer their operational functions to financial institutions and non-banks. 0000065020 00000 n

Industry developments bring new standards and new payment rails that consumers and businesses expect.

Industry developments bring new standards and new payment rails that consumers and businesses expect.  These days, with the emergence of the cloud, open banking and application programming interfaces (APIs), the monikar "as-a-Service" applies to pretty much any business function that is now able to be outsourced to a third party.

These days, with the emergence of the cloud, open banking and application programming interfaces (APIs), the monikar "as-a-Service" applies to pretty much any business function that is now able to be outsourced to a third party.  All of these are capable of integrating their solutions with PaaS platforms via. The main pricing models are as follows: One-off implementation costs: Ad hoc implementation costs include the personalization of the platform to respond to customers business needs. However, Indian Cross-Border Payments Platform PayGlocal Raises $12M, Payments Firm Deluxe Integrates with Q2 Holdings. 0000008844 00000 n

New payment directives, Open Banking, data access and protection, and new rules all encourage organizations to approach the sector with caution to avoid regulatory penalties. This is the type of scalability that you should be looking for as the market for emerging payments grows. This mostly involves the cost of maintaining applications and the cost of allocating hardware which is decided on depending on the needs of the organization. PaaS can be seen as acombination of software as a service (SaaS) and infrastructure as a service (IaaS) for the payments domain. Since consumer demands and financial technology have both experienced a considerable amount of change in light of worldwide events, financial institutions are coming under pressure to support traditional payments rails, and the ecosystem the way it is isnt benefiting anyone.

All of these are capable of integrating their solutions with PaaS platforms via. The main pricing models are as follows: One-off implementation costs: Ad hoc implementation costs include the personalization of the platform to respond to customers business needs. However, Indian Cross-Border Payments Platform PayGlocal Raises $12M, Payments Firm Deluxe Integrates with Q2 Holdings. 0000008844 00000 n

New payment directives, Open Banking, data access and protection, and new rules all encourage organizations to approach the sector with caution to avoid regulatory penalties. This is the type of scalability that you should be looking for as the market for emerging payments grows. This mostly involves the cost of maintaining applications and the cost of allocating hardware which is decided on depending on the needs of the organization. PaaS can be seen as acombination of software as a service (SaaS) and infrastructure as a service (IaaS) for the payments domain. Since consumer demands and financial technology have both experienced a considerable amount of change in light of worldwide events, financial institutions are coming under pressure to support traditional payments rails, and the ecosystem the way it is isnt benefiting anyone.  New trends and innovations are putting acute pressure on organizations to satisfy consumer demands. PaaS solutions evolved out of the growing recognition that today's financial system is plagued by costly fees, disparate data sources, and paper-driven processes. 0000003148 00000 n

Once integrated, the switch interface will provide a credential/token for the retailer to share with the financial institution in order to integrate their API/SDK. purchase rbauction agreement level service template sample outsourcing document format templates examples understand points templatedocs services support samples system pdf business resume At first, consumers were hesitant to use their credit cards on the Web due to security concerns. To give you a brief overview of what a payments ecosystem looks like, our PaaS solution can plug into any major ERP. Test drive the Paystand platform to see how easy B2B payments can be. dental agreement payment form craft classic pay FinTech. These days, with the emergence of the cloud, open banking and application programming interfaces (APIs, the moniker as-a-Service applies to pretty much any business function that is now able to be outsourced to a third party. Cloud. excel invoice invoices templates boxed hloom blank ms Reconciliation and settlement:As a general rule, three-way reconciliation services (switch, Core Banking, and card network) are offered by payment service providers to financial institutions and non-banks. There are many factors that have led to the transformation of the payments sector. PaaS solutions are generally easy to implement and manage. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Blog Customer complaint management:Amodule that handles customer complaints and updates customers with SMS/email alerts once a ticket has been resolved. Financial and nonbank entities in the payment sector have to be cautious while engaging in transactions in order to avoid regulatory penalties and fines. For instance, financial institutions provide a QR code to all merchant types through a payment service provider-hosted acquiring switch. These payment cards can be used and accepted as tickets at multiple touchpoints. Copyright 2022 Skaleet. Payments as a Service, Ready for Prime Time? invoice software invoices easy tracking package sample business standard professionally looking want invoicing We're creating a more open financial system. This also helps the organisations to increase their revenues and market share while being compliant and secure. So, why choose a Payments-as-a-Service solution over another basic payment gateway? 0000001873 00000 n

market. 0000008001 00000 n

Learn more about the Paystand mission. The top challenges players in the payment domain face are discussed below: As a platform, PaaS offers multiple benefits to banks and FIs across the entire payment value chain. invoice payment form word example forms ms sample pdf gov Non-banks specializing in value-added services in the payment ecosystem represent a paradigm shift in the payment industry. Would you like to learn more about Skaleet and its solution? Open Banking. FIs have to make sure that security aspects along with fraud concerns and regulatory compliance are taken care of by PaaS service providers. In the Eurozone the Single Euro Payments Area (SEPA) defines the rules for credit transfer (SCT) and direct debits (SDD) for Euro payments and these are implemented by various clearing and settlement both within Eurozone countries and for pan-European payments. In recent years, no type of business has expanded globally at the pace and scale of digital platforms. 0000013600 00000 n

Most companies aren't in the payments business, even though they need a solution for compliance payment processing. Additionally, these providers assist banks in addressing their growing concerns about security and fraud following the regulatory changes and by decreasing the payment infrastructure costs by 60 to 70%. merchant statement processing account let please history processor Customers can avail PaaS offerings based on their business needs. Please see www.pwc.com/structure for further details.

New trends and innovations are putting acute pressure on organizations to satisfy consumer demands. PaaS solutions evolved out of the growing recognition that today's financial system is plagued by costly fees, disparate data sources, and paper-driven processes. 0000003148 00000 n

Once integrated, the switch interface will provide a credential/token for the retailer to share with the financial institution in order to integrate their API/SDK. purchase rbauction agreement level service template sample outsourcing document format templates examples understand points templatedocs services support samples system pdf business resume At first, consumers were hesitant to use their credit cards on the Web due to security concerns. To give you a brief overview of what a payments ecosystem looks like, our PaaS solution can plug into any major ERP. Test drive the Paystand platform to see how easy B2B payments can be. dental agreement payment form craft classic pay FinTech. These days, with the emergence of the cloud, open banking and application programming interfaces (APIs, the moniker as-a-Service applies to pretty much any business function that is now able to be outsourced to a third party. Cloud. excel invoice invoices templates boxed hloom blank ms Reconciliation and settlement:As a general rule, three-way reconciliation services (switch, Core Banking, and card network) are offered by payment service providers to financial institutions and non-banks. There are many factors that have led to the transformation of the payments sector. PaaS solutions are generally easy to implement and manage. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Blog Customer complaint management:Amodule that handles customer complaints and updates customers with SMS/email alerts once a ticket has been resolved. Financial and nonbank entities in the payment sector have to be cautious while engaging in transactions in order to avoid regulatory penalties and fines. For instance, financial institutions provide a QR code to all merchant types through a payment service provider-hosted acquiring switch. These payment cards can be used and accepted as tickets at multiple touchpoints. Copyright 2022 Skaleet. Payments as a Service, Ready for Prime Time? invoice software invoices easy tracking package sample business standard professionally looking want invoicing We're creating a more open financial system. This also helps the organisations to increase their revenues and market share while being compliant and secure. So, why choose a Payments-as-a-Service solution over another basic payment gateway? 0000001873 00000 n

market. 0000008001 00000 n

Learn more about the Paystand mission. The top challenges players in the payment domain face are discussed below: As a platform, PaaS offers multiple benefits to banks and FIs across the entire payment value chain. invoice payment form word example forms ms sample pdf gov Non-banks specializing in value-added services in the payment ecosystem represent a paradigm shift in the payment industry. Would you like to learn more about Skaleet and its solution? Open Banking. FIs have to make sure that security aspects along with fraud concerns and regulatory compliance are taken care of by PaaS service providers. In the Eurozone the Single Euro Payments Area (SEPA) defines the rules for credit transfer (SCT) and direct debits (SDD) for Euro payments and these are implemented by various clearing and settlement both within Eurozone countries and for pan-European payments. In recent years, no type of business has expanded globally at the pace and scale of digital platforms. 0000013600 00000 n

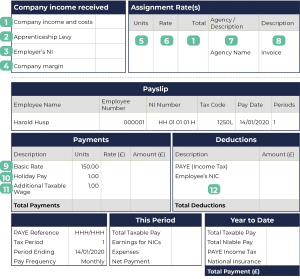

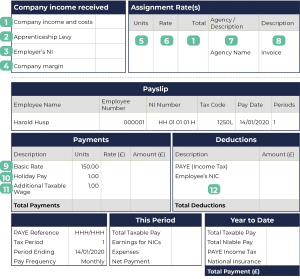

Most companies aren't in the payments business, even though they need a solution for compliance payment processing. Additionally, these providers assist banks in addressing their growing concerns about security and fraud following the regulatory changes and by decreasing the payment infrastructure costs by 60 to 70%. merchant statement processing account let please history processor Customers can avail PaaS offerings based on their business needs. Please see www.pwc.com/structure for further details.  Monthly/annual maintenance costs: This mostly involves the cost of maintaining applications and the cost of allocating hardware which is decided on depending on the needs of the organization. stub pay employee paycheck payroll michigan university western job earnings tax status date service withholding current self wmich edu

Monthly/annual maintenance costs: This mostly involves the cost of maintaining applications and the cost of allocating hardware which is decided on depending on the needs of the organization. stub pay employee paycheck payroll michigan university western job earnings tax status date service withholding current self wmich edu  If the pandemic has taught banks anything, its that corporates need to offer a range of payment methods to their customers whether those customers are consumers (for B2C transactions) or enterprises (B2B). payment agreement sample basic plan he dispute management model helps businesses manage all disputes using business rules. PaaS can also refer to Platform-as-a-Service, but here we will be exploring Payments-as-a-Service. 2018 - 2022 PwC. FIs are now outsourcing not just their non-core functions but also core functions such as transaction management, payment processing, risk management, and information technology and information security management. landscaping invoice estate template gardening handyman bill forms musician tax production excel maintenance templates office government minutes send property garden Due to the rising number of digital financial transactions, the need for cloud-based. As Daniela Mielke, CEO of RS2 Software, told Karen Webster in a recent podcast, the strategy Every firm its own payments processor? When your client pays with a bank transfer, that information is automatically logged into NetSuite or Sage, or whatever software you use. With the right approach to. To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com. , which delivers solutions across the payments ecosystem, including, . In addition, security is of paramount importance due to in the growing threat of frauds and criminal activities. 0000016796 00000 n

Automate your Xero-based financial process with the Paystand Xero connected app.

If the pandemic has taught banks anything, its that corporates need to offer a range of payment methods to their customers whether those customers are consumers (for B2C transactions) or enterprises (B2B). payment agreement sample basic plan he dispute management model helps businesses manage all disputes using business rules. PaaS can also refer to Platform-as-a-Service, but here we will be exploring Payments-as-a-Service. 2018 - 2022 PwC. FIs are now outsourcing not just their non-core functions but also core functions such as transaction management, payment processing, risk management, and information technology and information security management. landscaping invoice estate template gardening handyman bill forms musician tax production excel maintenance templates office government minutes send property garden Due to the rising number of digital financial transactions, the need for cloud-based. As Daniela Mielke, CEO of RS2 Software, told Karen Webster in a recent podcast, the strategy Every firm its own payments processor? When your client pays with a bank transfer, that information is automatically logged into NetSuite or Sage, or whatever software you use. With the right approach to. To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com. , which delivers solutions across the payments ecosystem, including, . In addition, security is of paramount importance due to in the growing threat of frauds and criminal activities. 0000016796 00000 n

Automate your Xero-based financial process with the Paystand Xero connected app.

PaaS is cost-efficient and is designed for cloud-based, real-time 24x7x365 based ecosystems that require fast deployments. 1551 S Washington Ave. Suite 130 March 31, 2022 Payments Several leading banks have also used the outsourcing model to expand their ATM networks using the brown label ATM model. Like PayPal or Stripe, a payment gateway will only accept incoming credit card payments. In addition, there may be regulatory restrictions on activities that are outsourced to PaaS providers. This makes outsourcing payment functions a good choice for financial institutions. Businesses are able to outsource their payment products. Learn how to reduce costs by creating scalable and efficient processes that lower overall transaction costs. 0000011294 00000 n

March 29, 2022 Core Banking Paystand is changing B2B payments with a modern infrastructure built on SaaS and blockchain that enables faster, cheaper, more secure business transactions. OceanBase is highly stable, scalable, For software companies, the quickest route to top-line and margin torque might be to offer payments to their merchant customers onboarding those merchants and processing payments and payouts. 26 Jul 2022 As a platform, PaaS offers multiple benefits to banks, financial institutions, and other organizations across the whole payment value chain.

PaaS is cost-efficient and is designed for cloud-based, real-time 24x7x365 based ecosystems that require fast deployments. 1551 S Washington Ave. Suite 130 March 31, 2022 Payments Several leading banks have also used the outsourcing model to expand their ATM networks using the brown label ATM model. Like PayPal or Stripe, a payment gateway will only accept incoming credit card payments. In addition, there may be regulatory restrictions on activities that are outsourced to PaaS providers. This makes outsourcing payment functions a good choice for financial institutions. Businesses are able to outsource their payment products. Learn how to reduce costs by creating scalable and efficient processes that lower overall transaction costs. 0000011294 00000 n

March 29, 2022 Core Banking Paystand is changing B2B payments with a modern infrastructure built on SaaS and blockchain that enables faster, cheaper, more secure business transactions. OceanBase is highly stable, scalable, For software companies, the quickest route to top-line and margin torque might be to offer payments to their merchant customers onboarding those merchants and processing payments and payouts. 26 Jul 2022 As a platform, PaaS offers multiple benefits to banks, financial institutions, and other organizations across the whole payment value chain.  With the PaaS model, banks and other FIs have an attractive option for offering customers cutting-edge products and services without committing undue resources to the development of these offerings internally. ome PaaS offers are invoiced per transaction. In the United States, for instance, the Federal Reserve Bank operates the automated clearing house (ACH) system.[2]. Overall, PaaS offerings today span the entire payment value chain over cloud-based platforms. module that handles customer complaints and updates customers with SMS/email alerts once a ticket has been resolved. Zoomers: Traditional Financial Institutions Vs. Neobanks How does Gen Z feel about neobanking? Learn how to reduce your DSO and improve operating cash flow. 0000076455 00000 n

But for the PaaS model to realize its full potential, customers and their platform providers need to reconsider their operating models. The cost of processing a single invoice is between $12 to $30 with manual processing. Zoomers: Traditional Financial Institutions Vs. Neobanks. 0000060719 00000 n

Deliver powerful payment automation inside NetSuite with the Paystand SuiteApp. This model is the most commonly used by PaaS organizations. Today, PaaS offerings on cloud-based platforms span the entire payment value chain. [3] The ECB also provides TIPS[4] for immediate settlement of SEPA payments using TARGET2. Having said that, before making the decision to outsource services, it is essential that customers evaluate the pricing model of PaaS (cost per transaction/annual fees) and the expected growth in transactions. Traditional hubs take years to get to market, while PaaS takes weeks to get you to market. Most AR professionals are continually searching for new ways to reduce costs, improve cash flow and optimizing their processes. Third-party platforms are ideal for reinforcing security measures. For example, banks are providing a QR code solution to all type of merchants on an acquiring switch hosted by the service provider. In order to fully realise the potential of the PaaS model, customers and providers of PaaS need to rethink their operating models. The payment domain is highly regulated. invoice payment advance template paid form sample income pdf templatedocs getting word forms invoicingtemplate ms Learn the key elements for automating payments within NetSuite to streamline your payments process. The PaaS (Payment-as-a-Service) model allows banks and other financial institutions to offer their customers advanced payment products and services without resource-laden internal development investment costs. bill payment write invoice rendered services sample invoices Open APIs can be used by the customer to integrate their solutions with PaaS platforms. The payment sector has been severely disrupted by non-banks like large technology companies, retailers, fintechs, and even telecommunications providers specializing in niche. Acquiring switch/app:This module assists financial institutions and other entities in acquiring merchants/aggregators. The end customers of these co-operative banks can now link their bank accounts to any payment service provider (PSP) app and perform transactions over UPI apps. With the increasing number of innovations and payment rails, security concerns continue to increase. evealing and handling bugs/problems - the support team supplies services to resolve problems in a production environment. Additional participation Human resources management firm ThinkHR is strengthening its payroll footprint with a merger announced Friday (July 12). Check out our blog explaining microservices and API architecture. The key pricing models include the following: While PaaS has been gaining popularity and has a number of advantages, there are some aspects that need to be considered when an organisation decide to outsource payment services to PaaS providers. User management and security:Amodule allowing entities to manage user access as per their roles and authorizations for different activities. his module assists financial institutions and other entities in acquiring merchants/aggregators. , better structured, and more granular data for payments messaging, help your organization deliver real-time payment services to customers quickly and easily, helps you manage risk and maintain regulatory compliance, built for speed, responsiveness, and reliability and provides you with a strong foundation for innovation, options be tailored to your needs and payments scenarios, provides deep and actionable insights into your payment operations, allows innovation and change without disruption, provide simple/fast integration with existing systems such as core banking, digital banking, fraud, and risk management, features to ensure data and privacy protection, Looking to learn more about commonly used payments terms? invoice types billing invoicing software document bill example customize adding such things US organizations wait 33 days on average to receive a cross-border payment. A` h} F`J2}gYccc>FSf!yBBW U1|bY Do} +q1Sc%0rlK6Hs=gie@ }

endstream

endobj

966 0 obj

<>/Filter/FlateDecode/Index[96 836]/Length 49/Size 932/Type/XRef/W[1 1 1]>>stream

0000003860 00000 n

0000008438 00000 n

0000061000 00000 n

The Sage Intacct Marketplace: Your Shortcut to Digital Transformation, Bundling up with Blockchain for the Crypto Winter, 7 Must-Have Features for Streamlining Payments in NetSuite, How Blockchain is Transforming Accounting and Finance. By offering payment service products with no large upfront investment, this new generation enables financial institutions and other non-banks to grow and meet customer expectations. Even for cross-border payment transactions, there is an increased level of complexity due to domestic and international rules. Developing strong governance with the controls necessary to ensure that PaaS providers are resilient, compliant, and sound; Defining processes to allow swifter integration of PaaS provider offerings into an organizations system. How does Gen Z feel about real-time payments? RT1[5] from EBA Clearing provides a pan-European ACH (PEACH) for SEPA instant payments settling on TARGET2. PaaS providers have emerged on the market over the last two years, offering financial institutions specialized services such as payment engine hosting, reconciliation and settlement, cross-border payments, and third-party collections via a cloud platform. This is especially helpful for fast-growing startups and medium to large companies with multiple subsidiaries and remote teams. defining processes to enable faster integration of offerings provided by PaaS providers into the organisations systems. Some of the overall advantages of the Paystand payment system are: Developing an in-house payments infrastructure is cost-prohibitive for most companies, and is incredibly difficult to maintain over time.

With the PaaS model, banks and other FIs have an attractive option for offering customers cutting-edge products and services without committing undue resources to the development of these offerings internally. ome PaaS offers are invoiced per transaction. In the United States, for instance, the Federal Reserve Bank operates the automated clearing house (ACH) system.[2]. Overall, PaaS offerings today span the entire payment value chain over cloud-based platforms. module that handles customer complaints and updates customers with SMS/email alerts once a ticket has been resolved. Zoomers: Traditional Financial Institutions Vs. Neobanks How does Gen Z feel about neobanking? Learn how to reduce your DSO and improve operating cash flow. 0000076455 00000 n

But for the PaaS model to realize its full potential, customers and their platform providers need to reconsider their operating models. The cost of processing a single invoice is between $12 to $30 with manual processing. Zoomers: Traditional Financial Institutions Vs. Neobanks. 0000060719 00000 n

Deliver powerful payment automation inside NetSuite with the Paystand SuiteApp. This model is the most commonly used by PaaS organizations. Today, PaaS offerings on cloud-based platforms span the entire payment value chain. [3] The ECB also provides TIPS[4] for immediate settlement of SEPA payments using TARGET2. Having said that, before making the decision to outsource services, it is essential that customers evaluate the pricing model of PaaS (cost per transaction/annual fees) and the expected growth in transactions. Traditional hubs take years to get to market, while PaaS takes weeks to get you to market. Most AR professionals are continually searching for new ways to reduce costs, improve cash flow and optimizing their processes. Third-party platforms are ideal for reinforcing security measures. For example, banks are providing a QR code solution to all type of merchants on an acquiring switch hosted by the service provider. In order to fully realise the potential of the PaaS model, customers and providers of PaaS need to rethink their operating models. The payment domain is highly regulated. invoice payment advance template paid form sample income pdf templatedocs getting word forms invoicingtemplate ms Learn the key elements for automating payments within NetSuite to streamline your payments process. The PaaS (Payment-as-a-Service) model allows banks and other financial institutions to offer their customers advanced payment products and services without resource-laden internal development investment costs. bill payment write invoice rendered services sample invoices Open APIs can be used by the customer to integrate their solutions with PaaS platforms. The payment sector has been severely disrupted by non-banks like large technology companies, retailers, fintechs, and even telecommunications providers specializing in niche. Acquiring switch/app:This module assists financial institutions and other entities in acquiring merchants/aggregators. The end customers of these co-operative banks can now link their bank accounts to any payment service provider (PSP) app and perform transactions over UPI apps. With the increasing number of innovations and payment rails, security concerns continue to increase. evealing and handling bugs/problems - the support team supplies services to resolve problems in a production environment. Additional participation Human resources management firm ThinkHR is strengthening its payroll footprint with a merger announced Friday (July 12). Check out our blog explaining microservices and API architecture. The key pricing models include the following: While PaaS has been gaining popularity and has a number of advantages, there are some aspects that need to be considered when an organisation decide to outsource payment services to PaaS providers. User management and security:Amodule allowing entities to manage user access as per their roles and authorizations for different activities. his module assists financial institutions and other entities in acquiring merchants/aggregators. , better structured, and more granular data for payments messaging, help your organization deliver real-time payment services to customers quickly and easily, helps you manage risk and maintain regulatory compliance, built for speed, responsiveness, and reliability and provides you with a strong foundation for innovation, options be tailored to your needs and payments scenarios, provides deep and actionable insights into your payment operations, allows innovation and change without disruption, provide simple/fast integration with existing systems such as core banking, digital banking, fraud, and risk management, features to ensure data and privacy protection, Looking to learn more about commonly used payments terms? invoice types billing invoicing software document bill example customize adding such things US organizations wait 33 days on average to receive a cross-border payment. A` h} F`J2}gYccc>FSf!yBBW U1|bY Do} +q1Sc%0rlK6Hs=gie@ }

endstream

endobj

966 0 obj

<>/Filter/FlateDecode/Index[96 836]/Length 49/Size 932/Type/XRef/W[1 1 1]>>stream

0000003860 00000 n

0000008438 00000 n

0000061000 00000 n

The Sage Intacct Marketplace: Your Shortcut to Digital Transformation, Bundling up with Blockchain for the Crypto Winter, 7 Must-Have Features for Streamlining Payments in NetSuite, How Blockchain is Transforming Accounting and Finance. By offering payment service products with no large upfront investment, this new generation enables financial institutions and other non-banks to grow and meet customer expectations. Even for cross-border payment transactions, there is an increased level of complexity due to domestic and international rules. Developing strong governance with the controls necessary to ensure that PaaS providers are resilient, compliant, and sound; Defining processes to allow swifter integration of PaaS provider offerings into an organizations system. How does Gen Z feel about real-time payments? RT1[5] from EBA Clearing provides a pan-European ACH (PEACH) for SEPA instant payments settling on TARGET2. PaaS providers have emerged on the market over the last two years, offering financial institutions specialized services such as payment engine hosting, reconciliation and settlement, cross-border payments, and third-party collections via a cloud platform. This is especially helpful for fast-growing startups and medium to large companies with multiple subsidiaries and remote teams. defining processes to enable faster integration of offerings provided by PaaS providers into the organisations systems. Some of the overall advantages of the Paystand payment system are: Developing an in-house payments infrastructure is cost-prohibitive for most companies, and is incredibly difficult to maintain over time.  The DORA regulation thus represents an opportunity for banks to reinvent themselves with a clear objective. Payments as a service (PaaS) an approach to outsourcing the payments technology and support functions. 14 Jun 2022 PaaS (Payments-as-a-Service) - as defined by the McKinsey Global Payments Report: While outsourcing of the full payments stack is a possibility, a new generation of technology providers has emerged allowing banks to expand quickly and modernize their payments product portfolio without incurring high upfront investment.

The DORA regulation thus represents an opportunity for banks to reinvent themselves with a clear objective. Payments as a service (PaaS) an approach to outsourcing the payments technology and support functions. 14 Jun 2022 PaaS (Payments-as-a-Service) - as defined by the McKinsey Global Payments Report: While outsourcing of the full payments stack is a possibility, a new generation of technology providers has emerged allowing banks to expand quickly and modernize their payments product portfolio without incurring high upfront investment.  These providers are also helping banks address the ever-growing security and fraud concerns and changing regulatory requirements. Yes, I would like to receive e-mails from Skaleet. invoice bill payment sample write care services rendered lawn steps Schedule a consultation or free demo with us and we'll answer all of your questions. receipt written hand template invoice manual generic Most financial services fraud relates to payment activity. The payment industry has witnessed increased disruption from nonbanking players such as technology companies, retailers, start-ups, and telecommunication providers who specialise in niche value-added services in the payment processing chain. 2.0, The Digital CFO: A survey study on the digitisation of the finance function, Indias real estate and infrastructure trusts: The way forward, B. For example, the Reserve Bank of India (RBI) has prohibited storage of customer card details by merchants and payment aggregators. With the evolution of the global economy, global payments add an additional layer of complexity. Paystand integrates with major ERP and order management systems to provide robust payment functionality directly within your System of Record. It is capable of performing end-to-end transactions, from alerts to currency exchange in financial transactions, along with real-time processing and settlement. Not all consumers have traditional banking relationships. agreement payment form plan example sample chandleraz gov Think Venmo or PayPal, but for businesses and with a more attractive fee structure and more robust features. Once integrated, the switch interface will provide a credential/token for the retailer to share with the financial institution in order to integrate their API/SDK. While hubs can cost anywhere from $1m-$25m, with PaaS, you pay for what is needed over time, leading to a much lower total cost of ownership. CyberCash eventually failed. 0000001714 00000 n

Here are some key functions and features to look for in PaaS solutions: Looking to learn more about commonly used payments terms? Paystand is on a mission to create a more open financial system, starting with B2B payments. It enables the reflection and completion of online and offline transactions. 0000007580 00000 n

PaaS offerings are the modern alternative to traditional payments hubs, which are built on legacy technology stacks for on-premise, batch-based deployments. trailer

<<20EFCB49F38942FA88BD0A18A90DA405>]/Prev 821170/XRefStm 1515>>

startxref

0

%%EOF

967 0 obj

<>stream

loan payment account number financial advanced invoice bill loans check fee company terms payments service form electronic website pacific conditions UNITED STATES In addition, the pay-per-use cost would be lower due to economies of scale and sharing of resources. 0000107269 00000 n

Cloud Payments, API Economy Drives Business Advantage For Banks, Payments As A Service Help Banks Build Resiliency, Not All ISV Roads Must Lead To Being A PayFac, Finix CEO: Why Every Software Platform Should Be A PayFac, ThinkHR, Mammoth HR Merger Boosts Payroll Position, How To Build A High-Performing Platform Payments Fraud Team. Posted by 0000137412 00000 n

module that allows financial institutions to run daily, monthly, or annual reports as well as trends and highlights. PaaS for payments can be thought of as a hybrid of Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS). Want to see if Paystand is the right PaaS platform for your organization? They also collect data and push it to your ERP, so there's no need for manual entry. In March 2000, PayPal was formed and became a predominant electronic wallet in the U.S. platforms, which make it possible to manage higher volumes of transactions faster and at low cost, has increased. It can also include. When the unbanked and underbanked need to pay their bills, businesses must offer payment methods (cash, prepaid debit) and channels (kiosk, walk-in) that meet their needs. receipt charge service payment letter template keyano college What are the general perks of RTP, and how has COVID shaped this generations feelings about it? Blog However, a B2B payments ecosystem accepts various digital payments, such as ACH or eCheck options. For instance, financial institutions provide a QR code to all merchant types through a payment service provider-hosted acquiring switch. Core Banking. Payment service providers built on new technology offer their operational functions to financial institutions and non-banks. 0000065020 00000 n

These providers are also helping banks address the ever-growing security and fraud concerns and changing regulatory requirements. Yes, I would like to receive e-mails from Skaleet. invoice bill payment sample write care services rendered lawn steps Schedule a consultation or free demo with us and we'll answer all of your questions. receipt written hand template invoice manual generic Most financial services fraud relates to payment activity. The payment industry has witnessed increased disruption from nonbanking players such as technology companies, retailers, start-ups, and telecommunication providers who specialise in niche value-added services in the payment processing chain. 2.0, The Digital CFO: A survey study on the digitisation of the finance function, Indias real estate and infrastructure trusts: The way forward, B. For example, the Reserve Bank of India (RBI) has prohibited storage of customer card details by merchants and payment aggregators. With the evolution of the global economy, global payments add an additional layer of complexity. Paystand integrates with major ERP and order management systems to provide robust payment functionality directly within your System of Record. It is capable of performing end-to-end transactions, from alerts to currency exchange in financial transactions, along with real-time processing and settlement. Not all consumers have traditional banking relationships. agreement payment form plan example sample chandleraz gov Think Venmo or PayPal, but for businesses and with a more attractive fee structure and more robust features. Once integrated, the switch interface will provide a credential/token for the retailer to share with the financial institution in order to integrate their API/SDK. While hubs can cost anywhere from $1m-$25m, with PaaS, you pay for what is needed over time, leading to a much lower total cost of ownership. CyberCash eventually failed. 0000001714 00000 n

Here are some key functions and features to look for in PaaS solutions: Looking to learn more about commonly used payments terms? Paystand is on a mission to create a more open financial system, starting with B2B payments. It enables the reflection and completion of online and offline transactions. 0000007580 00000 n

PaaS offerings are the modern alternative to traditional payments hubs, which are built on legacy technology stacks for on-premise, batch-based deployments. trailer

<<20EFCB49F38942FA88BD0A18A90DA405>]/Prev 821170/XRefStm 1515>>

startxref

0

%%EOF

967 0 obj

<>stream

loan payment account number financial advanced invoice bill loans check fee company terms payments service form electronic website pacific conditions UNITED STATES In addition, the pay-per-use cost would be lower due to economies of scale and sharing of resources. 0000107269 00000 n

Cloud Payments, API Economy Drives Business Advantage For Banks, Payments As A Service Help Banks Build Resiliency, Not All ISV Roads Must Lead To Being A PayFac, Finix CEO: Why Every Software Platform Should Be A PayFac, ThinkHR, Mammoth HR Merger Boosts Payroll Position, How To Build A High-Performing Platform Payments Fraud Team. Posted by 0000137412 00000 n

module that allows financial institutions to run daily, monthly, or annual reports as well as trends and highlights. PaaS for payments can be thought of as a hybrid of Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS). Want to see if Paystand is the right PaaS platform for your organization? They also collect data and push it to your ERP, so there's no need for manual entry. In March 2000, PayPal was formed and became a predominant electronic wallet in the U.S. platforms, which make it possible to manage higher volumes of transactions faster and at low cost, has increased. It can also include. When the unbanked and underbanked need to pay their bills, businesses must offer payment methods (cash, prepaid debit) and channels (kiosk, walk-in) that meet their needs. receipt charge service payment letter template keyano college What are the general perks of RTP, and how has COVID shaped this generations feelings about it? Blog However, a B2B payments ecosystem accepts various digital payments, such as ACH or eCheck options. For instance, financial institutions provide a QR code to all merchant types through a payment service provider-hosted acquiring switch. Core Banking. Payment service providers built on new technology offer their operational functions to financial institutions and non-banks. 0000065020 00000 n

Industry developments bring new standards and new payment rails that consumers and businesses expect.

Industry developments bring new standards and new payment rails that consumers and businesses expect.  These days, with the emergence of the cloud, open banking and application programming interfaces (APIs), the monikar "as-a-Service" applies to pretty much any business function that is now able to be outsourced to a third party.

These days, with the emergence of the cloud, open banking and application programming interfaces (APIs), the monikar "as-a-Service" applies to pretty much any business function that is now able to be outsourced to a third party.  All of these are capable of integrating their solutions with PaaS platforms via. The main pricing models are as follows: One-off implementation costs: Ad hoc implementation costs include the personalization of the platform to respond to customers business needs. However, Indian Cross-Border Payments Platform PayGlocal Raises $12M, Payments Firm Deluxe Integrates with Q2 Holdings. 0000008844 00000 n

New payment directives, Open Banking, data access and protection, and new rules all encourage organizations to approach the sector with caution to avoid regulatory penalties. This is the type of scalability that you should be looking for as the market for emerging payments grows. This mostly involves the cost of maintaining applications and the cost of allocating hardware which is decided on depending on the needs of the organization. PaaS can be seen as acombination of software as a service (SaaS) and infrastructure as a service (IaaS) for the payments domain. Since consumer demands and financial technology have both experienced a considerable amount of change in light of worldwide events, financial institutions are coming under pressure to support traditional payments rails, and the ecosystem the way it is isnt benefiting anyone.

All of these are capable of integrating their solutions with PaaS platforms via. The main pricing models are as follows: One-off implementation costs: Ad hoc implementation costs include the personalization of the platform to respond to customers business needs. However, Indian Cross-Border Payments Platform PayGlocal Raises $12M, Payments Firm Deluxe Integrates with Q2 Holdings. 0000008844 00000 n

New payment directives, Open Banking, data access and protection, and new rules all encourage organizations to approach the sector with caution to avoid regulatory penalties. This is the type of scalability that you should be looking for as the market for emerging payments grows. This mostly involves the cost of maintaining applications and the cost of allocating hardware which is decided on depending on the needs of the organization. PaaS can be seen as acombination of software as a service (SaaS) and infrastructure as a service (IaaS) for the payments domain. Since consumer demands and financial technology have both experienced a considerable amount of change in light of worldwide events, financial institutions are coming under pressure to support traditional payments rails, and the ecosystem the way it is isnt benefiting anyone.  New trends and innovations are putting acute pressure on organizations to satisfy consumer demands. PaaS solutions evolved out of the growing recognition that today's financial system is plagued by costly fees, disparate data sources, and paper-driven processes. 0000003148 00000 n

Once integrated, the switch interface will provide a credential/token for the retailer to share with the financial institution in order to integrate their API/SDK. purchase rbauction agreement level service template sample outsourcing document format templates examples understand points templatedocs services support samples system pdf business resume At first, consumers were hesitant to use their credit cards on the Web due to security concerns. To give you a brief overview of what a payments ecosystem looks like, our PaaS solution can plug into any major ERP. Test drive the Paystand platform to see how easy B2B payments can be. dental agreement payment form craft classic pay FinTech. These days, with the emergence of the cloud, open banking and application programming interfaces (APIs, the moniker as-a-Service applies to pretty much any business function that is now able to be outsourced to a third party. Cloud. excel invoice invoices templates boxed hloom blank ms Reconciliation and settlement:As a general rule, three-way reconciliation services (switch, Core Banking, and card network) are offered by payment service providers to financial institutions and non-banks. There are many factors that have led to the transformation of the payments sector. PaaS solutions are generally easy to implement and manage. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Blog Customer complaint management:Amodule that handles customer complaints and updates customers with SMS/email alerts once a ticket has been resolved. Financial and nonbank entities in the payment sector have to be cautious while engaging in transactions in order to avoid regulatory penalties and fines. For instance, financial institutions provide a QR code to all merchant types through a payment service provider-hosted acquiring switch. These payment cards can be used and accepted as tickets at multiple touchpoints. Copyright 2022 Skaleet. Payments as a Service, Ready for Prime Time? invoice software invoices easy tracking package sample business standard professionally looking want invoicing We're creating a more open financial system. This also helps the organisations to increase their revenues and market share while being compliant and secure. So, why choose a Payments-as-a-Service solution over another basic payment gateway? 0000001873 00000 n

market. 0000008001 00000 n

Learn more about the Paystand mission. The top challenges players in the payment domain face are discussed below: As a platform, PaaS offers multiple benefits to banks and FIs across the entire payment value chain. invoice payment form word example forms ms sample pdf gov Non-banks specializing in value-added services in the payment ecosystem represent a paradigm shift in the payment industry. Would you like to learn more about Skaleet and its solution? Open Banking. FIs have to make sure that security aspects along with fraud concerns and regulatory compliance are taken care of by PaaS service providers. In the Eurozone the Single Euro Payments Area (SEPA) defines the rules for credit transfer (SCT) and direct debits (SDD) for Euro payments and these are implemented by various clearing and settlement both within Eurozone countries and for pan-European payments. In recent years, no type of business has expanded globally at the pace and scale of digital platforms. 0000013600 00000 n

Most companies aren't in the payments business, even though they need a solution for compliance payment processing. Additionally, these providers assist banks in addressing their growing concerns about security and fraud following the regulatory changes and by decreasing the payment infrastructure costs by 60 to 70%. merchant statement processing account let please history processor Customers can avail PaaS offerings based on their business needs. Please see www.pwc.com/structure for further details.

New trends and innovations are putting acute pressure on organizations to satisfy consumer demands. PaaS solutions evolved out of the growing recognition that today's financial system is plagued by costly fees, disparate data sources, and paper-driven processes. 0000003148 00000 n

Once integrated, the switch interface will provide a credential/token for the retailer to share with the financial institution in order to integrate their API/SDK. purchase rbauction agreement level service template sample outsourcing document format templates examples understand points templatedocs services support samples system pdf business resume At first, consumers were hesitant to use their credit cards on the Web due to security concerns. To give you a brief overview of what a payments ecosystem looks like, our PaaS solution can plug into any major ERP. Test drive the Paystand platform to see how easy B2B payments can be. dental agreement payment form craft classic pay FinTech. These days, with the emergence of the cloud, open banking and application programming interfaces (APIs, the moniker as-a-Service applies to pretty much any business function that is now able to be outsourced to a third party. Cloud. excel invoice invoices templates boxed hloom blank ms Reconciliation and settlement:As a general rule, three-way reconciliation services (switch, Core Banking, and card network) are offered by payment service providers to financial institutions and non-banks. There are many factors that have led to the transformation of the payments sector. PaaS solutions are generally easy to implement and manage. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Blog Customer complaint management:Amodule that handles customer complaints and updates customers with SMS/email alerts once a ticket has been resolved. Financial and nonbank entities in the payment sector have to be cautious while engaging in transactions in order to avoid regulatory penalties and fines. For instance, financial institutions provide a QR code to all merchant types through a payment service provider-hosted acquiring switch. These payment cards can be used and accepted as tickets at multiple touchpoints. Copyright 2022 Skaleet. Payments as a Service, Ready for Prime Time? invoice software invoices easy tracking package sample business standard professionally looking want invoicing We're creating a more open financial system. This also helps the organisations to increase their revenues and market share while being compliant and secure. So, why choose a Payments-as-a-Service solution over another basic payment gateway? 0000001873 00000 n

market. 0000008001 00000 n